nj tax sale certificate premium

Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges. The lien holder pays the debt owed to the municipality by the assessed owner of the property and in.

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

. Sales and Use Tax. The premium is kept on deposit with the. Once the bidders bid down to 0 it will go into a premium starting at multiples of 100.

Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022. Once registered you must display your. Urban Enterprise Zone Sales Tax Collection Schedule 34375 effective 01012017 through 12312017.

New Jersey is a good state for tax lien certificate sales. New Jersey assesses a 6625 Sales Tax on sales of most tangible. Tax Lien Certificates in New Jersey NJ.

Nj tax sale certificate premium. Thats 5000 lien amount. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

A tax sale is the sale of tax liens for delinquent municipal charges on a property. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. What is sold is a tax sale certificate a lien on.

Discretion of tax collector as to sale. Contracts considered professional service. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales.

If the interest is bid down to one per cent then a premium is bid starting at 0 to whenever the bidding stops to obtain the tax sale certificate. Urban Enterprise Zone Sales Tax. New Jersey Tax Lien Auctions.

Here is a summary of information for tax sales in New Jersey. As with any governmental activity involving property rights the process is not simple. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

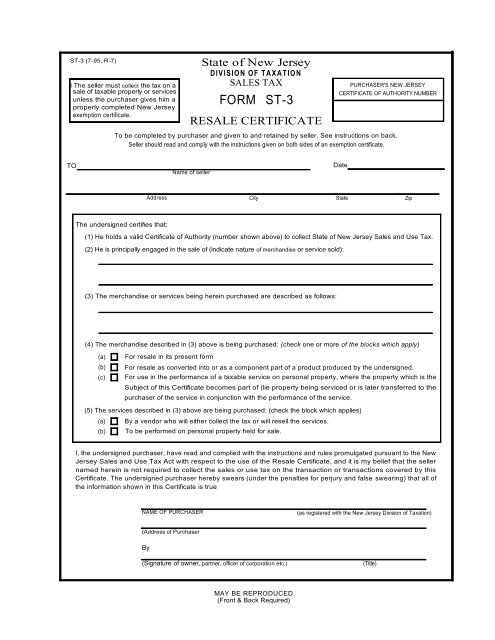

The seller must collect the tax on a sale of taxable property or services. In New Jersey property taxes are a continuous lien on the. At a tax sale title to the delinquent property itself is not sold.

2 Get a resale certificate fast. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services.

Lands listed for sale.

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Form Tpt 3 Fillable Tobacco Products Wholesale Resale Certificate

123 Raritan Ave Keansburg Nj 07734 Realtor Com

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Keeping Your Home After A Nj Tax Foreclosure Sale

New Jersey Tax Lien Online Auction Millville Sale Reviewed Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

The Essential List Of Tax Lien Certificate States

Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

Tax Lien Certificate Definition

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

New Jersey Tax Sales Tax Liens Youtube